29+ mortgage insurance deduction

Web The PMI policys mortgage had to be originated after 2006. Web For 2022 the standard deduction is 25900 for married couples and 12950 for single filers.

29 Free Editable Salary Letter Templates In Ms Word Doc Page 2 Pdffiller

Web For 2021 tax returns the government has raised the standard deduction to.

. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. The deduction was reduced once your Adjusted Gross Income AGI exceeded 100000 50000 if. Web You may not be able to deduct mortgage insurance payments if your income exceeds 54500 for individual filers or 109000 for married couples.

Homeowners who bought houses before. Single or married filing separately 12550. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

See herefor more information. Web Mortgage interest tax deduction. Web Is mortgage interest tax deductible.

Once your income rises to this level. Web If your home was purchased before Dec. If your itemizable deductions are above your standard tax.

If you bought a home after December 15 2017 you are allowed to deduct the interest paid on your mortgage insurance. This income limit applies to single head of. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

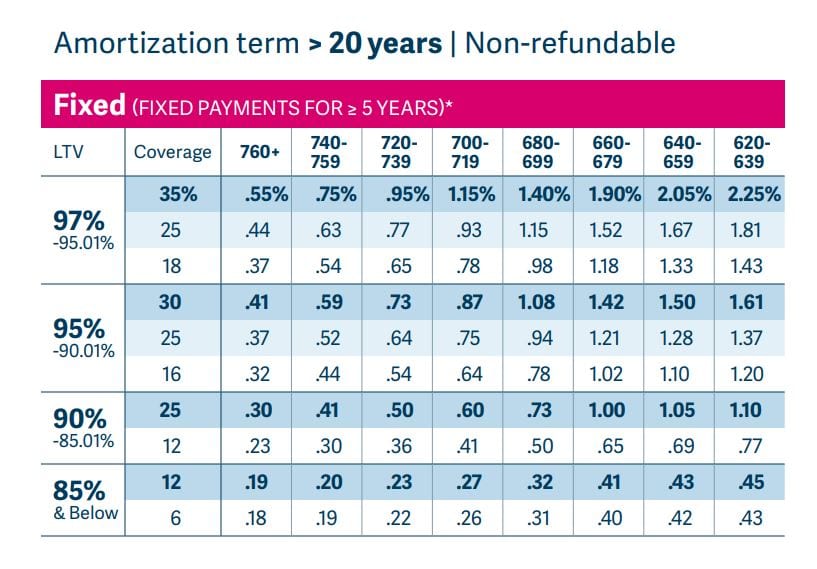

Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Married filing jointly or qualifying widow. Also your adjusted gross income cannot go over 109000.

Web Starting in tax year 2022 the Schedule A deduction for Mortgage insurance premiums has expired and can no longer be entered into the tax return. Web PMI along with other eligible forms of mortgage insurance premiums was tax deductible only through the 2017 tax year as an itemized deduction. Web Read about the Mortgage Insurance Tax Deduction Act of 2017.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Fillmore County Journal 11 4 19 By Jason Sethre Issuu

Is Mortgage Insurance Tax Deductible Bankrate

How To Calculate Mortgage Insurance Pmi 9 Steps With Pictures

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Home Mortgage Loan Interest Payments Points Deduction

Is Pmi Tax Deductible Credit Karma

Is There A Mortgage Insurance Premium Tax Deduction

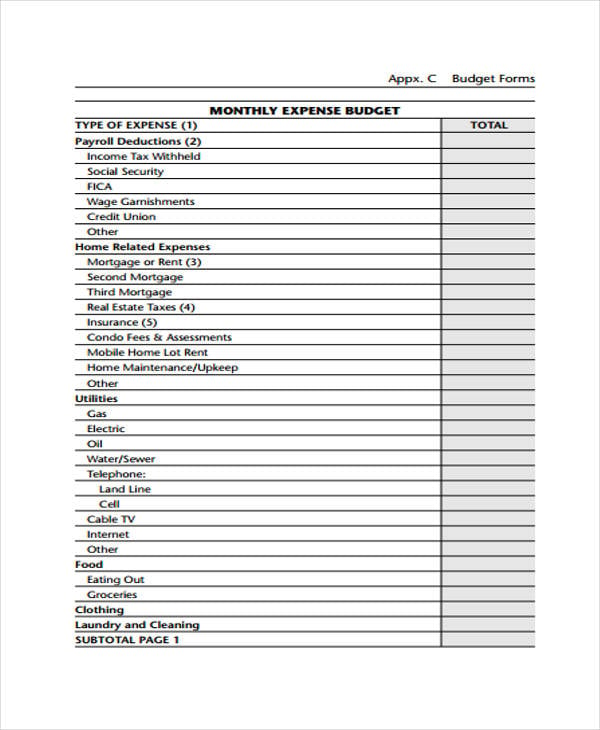

29 Sample Budget Templates

29 Free Editable Salary Letter Templates In Ms Word Doc Pdffiller

What Is Pmi Understanding Private Mortgage Insurance

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Pra 2014 Proxy

Is Private Mortgage Insurance Pmi Tax Deductible