Paycheck manager free payroll calculator

Income reported on other tax forms eg1099 K1 Allocated tips. Discover earnings from over 13 million W-2s across the country.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

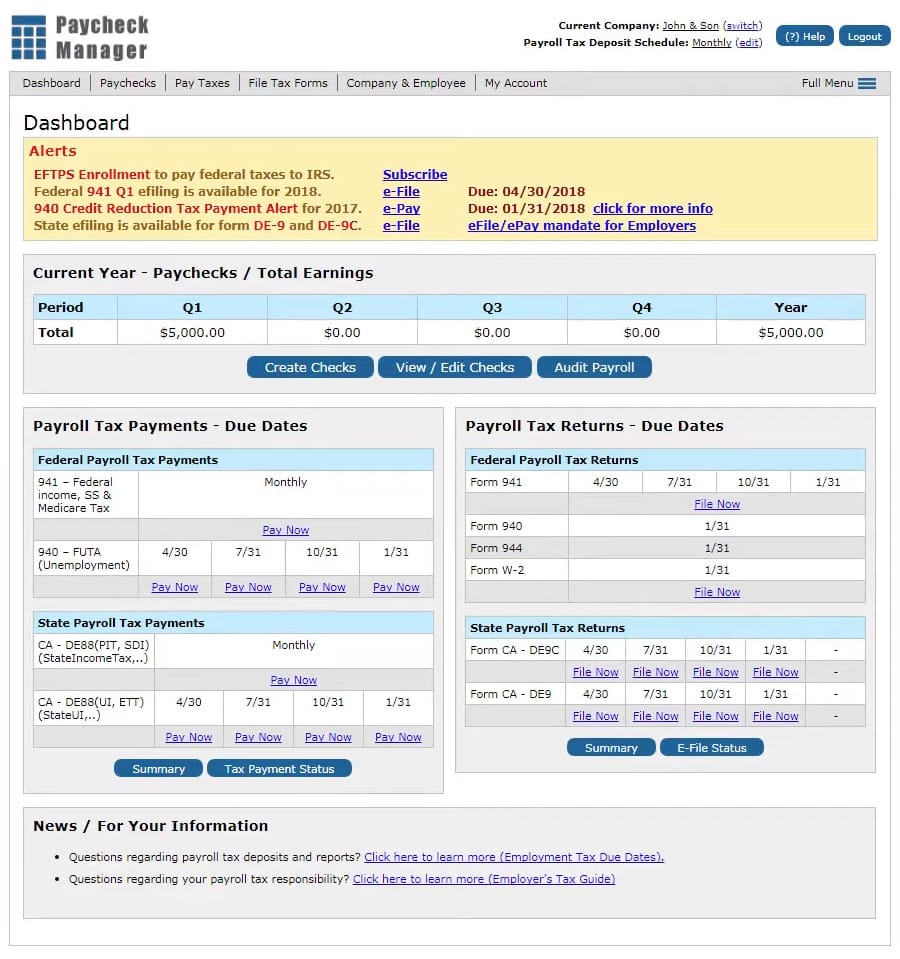

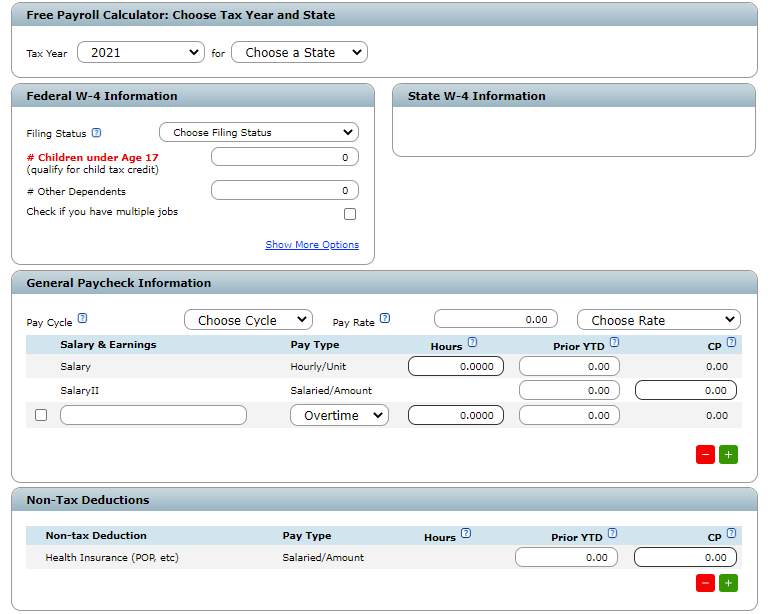

Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy.

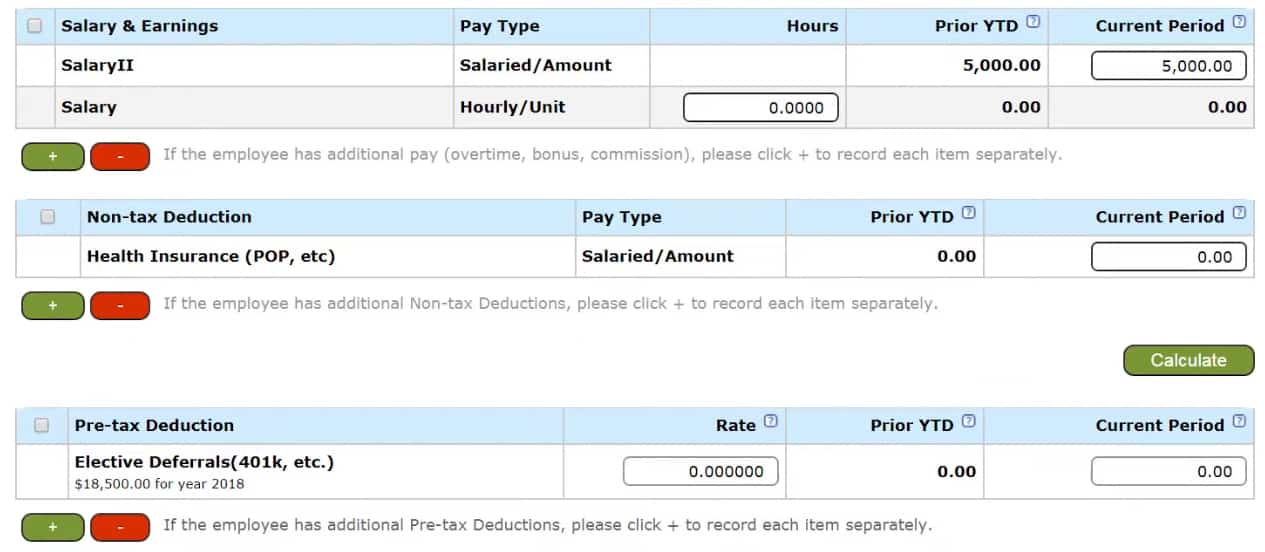

. Year Age Base Salary Signing Roster Restructure Cap Hit Dead Cap Yearly. If Paycheck Managers calculator seems too complex you can use its simple calculator to make basic tax estimates. Payroll management encompasses the entire process of calculating employee hours paying employees withholding taxes and maintaining the financial documentation for your business.

An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department. The charge for each domestic outgoing phone or branch wire in excess of three per statement cycle is 3000. Employees may also choose to contribute on a pre-tax or a Roth after tax basis.

Whether you pay your employees by printing off checks and distributing them or you use direct deposit make sure your payroll calculations have been done in time to pay everyone on the same date. Fast easy accurate payroll and tax so you save time and money. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

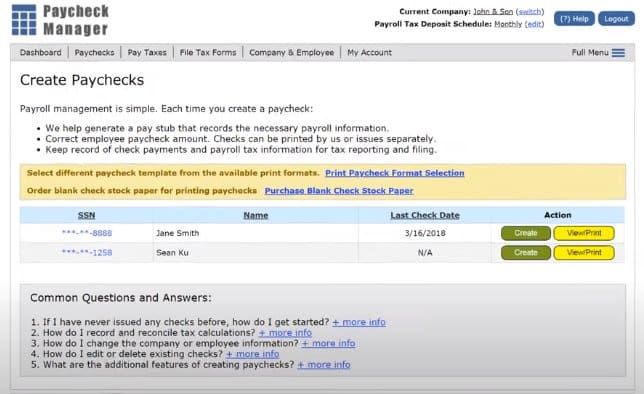

Eligible employees have access to leave retirement health and wellness benefits beginning on the first day of employment. Get your books stay on top with us and no binding contract we can manage your account outsourcing needs hassle free. Like eSmart Paycheck Paycheck Managers free calculator lets you calculate an employees net salary then print paychecks and create pay stubs.

People who want tax-free withdrawals in retirement. Your paycheck is just a part of your total compensation. Withdrawals and earnings are.

Make the process faster by using our payroll system requirements template to easily pick and prioritize features and see which products are the best match. 406 444-9855 or toll free at 1-800-346-5437 in state only. Get the latest financial news headlines and analysis from CBS MoneyWatch.

Want to save your payroll calculator data access payroll reports and offer pay. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use. When your son or daughter reaches legal age 18 19 or 21 depending which state you live in control of the custodial.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. Check out the QuickBooks Time employee cost calculator. Payroll Sheet Paycheck Federal Dues State Dues Form 940 Form 941 etc.

Take home the paycheck you deserve You work hard and your salary should reflect that. Any individuals with taxable income who earn 144000 or less per year or 214000 if married filing jointly. Savings Plus contributions are made by automatic payroll deductions that go into investment options the employee selects from the Savings Plus portfolio.

Cost of Living Calculator Tips to Negotiate a Cost of Living Adjustment. Payroll runs the employees last paycheck using the old pay rate to calculate earnings. Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal income tax withholding this year.

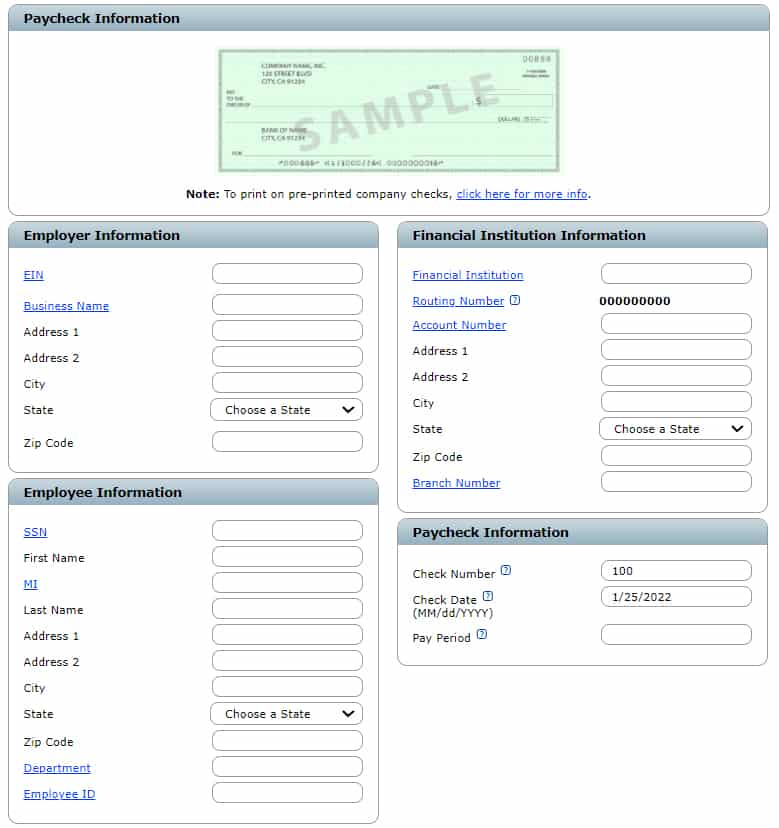

Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. The best way to keep all of your employees happy is to make sure everyone gets paid on time. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

If youre expecting a big refund. More Information on Paycheck Taxes. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use.

Using our payroll system requirements template educate yourself about the best-matched payroll software for your business will help you make the best decision for your needs. 2025 UFA Bonus Breakdown Cap Details Cash Details. Pay Rate Salary.

Manish has been great to work with very patient and very thorough. Run payroll with ease. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. To increase the chances of a fruitful discussion prepare by pulling together information from the managers 360-feedback and other performance results. The information contained on this page is intended for State of Montana employees who need to.

You can prepare form 941 W-2 1099-misc and others one at a time online or upload a data file to file by the thousands. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. 30-day free trial First thirty 30 days of subscription to QuickBooks Time starting from the date of enrollment is free.

Finance Manager - UK Based Beverages Retail Company. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise. If you have questions about other amounts or tax items on your paycheck stub check with your manager or your human resources department.

Employees may choose to contribute to a 401k Plan a 457b Plan or both. Track time and projects on the go. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

Be sure that all information you plan to review with the manager is accurate ties directly to the managers performance and covers aspects of their role they can control. ESmart Payroll has been providing IRS authorized payroll e-file since 2000. We provide solutions to make paying your employees as simple and accurate as possible.

You can print PDF copies after submission or ask us to print and mail forms W-2 W-2c and 1099-misc. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy. To continue using.

You contribute to the account like you would a 529 plan and an account manager invests the money for you. For Key Business Rewards Checking account customers there is no charge for domestic incoming wires and up to three free domestic outgoing phone or branch initiated wires per monthly statement period.

Paycheck Manager Review Is It The Right Payroll Software For Your Business

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Manager Review Is It The Right Payroll Software For Your Business

6 Best Free Payroll Software For Small Businesses Of 2021

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Manager Review Is It The Right Payroll Software For Your Business

15 Free Payroll Templates Smartsheet

Payroll Calculator Free Employee Payroll Template For Excel

Free Payroll Tax Paycheck Calculator Youtube

Free Payroll Tax Calculator Free Paycheck Calculation

Paycheck Manager Review Is It The Right Payroll Software For Your Business

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Manager Free Payroll Calculator Demo Step 2

Paycheck Manager In 2022 Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices

Paycheck Manager Review Is It The Right Payroll Software For Your Business